The economics of oil and gas production are heavily dependent on oil prices. As oil prices fluctuate, so do the profits and losses of oil and gas producers. This means that COOs of oil and gas companies must be able to anticipate and adapt to changes in the market in order to protect their operations from the downside of low oil prices. Everyone tries to predict Oil prices reality always seems a little bit further than expectation, given below is how many times Goldman Sachs has revised their Oil price forecasts within 15 days

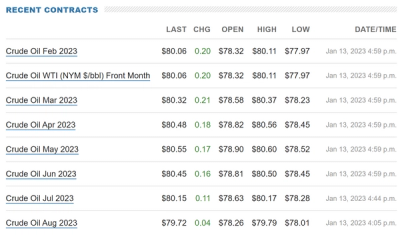

Reality is we're at $80.06/barrel

- Revised to $92/barrel (Dec 14, 2022) Goldman sees oil market surplus in early 2023, slashes price forecasts

- Forecasted at $110/barrel (Noc 29, 2022) - Oil prices are headed to $110 a barrel in 2023, and the outlook for crude is 'very positive' despite China demand concerns and global recession fears, Goldman Sachs says

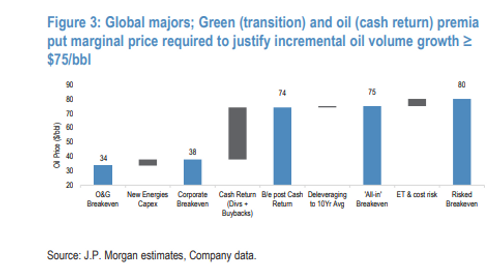

JPMorgan Says Drillers Need to See Higher Oil Prices According to JP Morgan, shale producers need prices to be above $75/barrel in order to be profitable. This highlights the importance of oil prices for the economics of oil and gas production. When prices are below this threshold, many producers may struggle to make a profit.

It is important to consider the current state of the oil market, specifically the forward curve, in this case, it is neither in contango or backwardation, that means that the prices are relatively stable and there is no indication of oversupply or scarcity. This would indicate that the market is balanced and prices are not expected to change significantly in the short term.

Backwardation and contango are terms used to describe the shape of the forward curve for a commodity, such as oil. The forward curve is a graph that shows the relationship between the price of a commodity for delivery at different future dates.

Backwardation occurs when the price for delivery in the near future is higher than the price for delivery at a later date. This can occur when there is a tight supply of the commodity in the short term, which drives up the price for immediate delivery. This is considered a bullish signal for the commodity, as it suggests that demand is strong and that there is a sense of scarcity in the market.

Contango, on the other hand, occurs when the price for delivery in the near future is lower than the price for delivery at a later date. This can occur when there is an oversupply of the commodity in the short term, which drives down the price for immediate delivery. This is considered a bearish signal for the commodity, as it suggests that demand is weak and that there is a sense of abundance in the market.

In summary, backwardation is a bullish signal that indicates a tight supply and strong demand, while contango is a bearish signal that indicates an oversupply and weak demand.

Futures are relatively stable

In this scenario, high-performing COOs of oil and gas companies may employ a variety of strategies to optimize their operations and maximize profits. Here are a few examples:

ROI on Drilling and Fracking

It is important to consider the ROI (Return on Investment) on drilling and fracking right now. If the ROI is favorable and the costs of drilling and fracking are reasonable, then it may be a good time to ramp up drilling activities. However, if the ROI is not favorable or the costs of drilling and fracking are high, it may be more prudent to hold off on drilling and focus on other areas of the business. Secondly, it is important to consider the average price to drill and frac right now versus later. If the costs of drilling and fracking are currently high, but expected to decrease in the future, it may be more beneficial to wait to ramp up drilling activities until costs decrease.

Currently labor costs, scarcity of supply is posing an issue for drilling.

- "Smaller producers may want to ramp production, but they may struggle "to get rigs and supplies necessary to drill and complete wells," said Bradley Williams, CEO of Dallas-based Elephant Oil & Gas."

- Labor shortages, supply chain issues, hesitant financial backers and a frosty relationship with the Biden administration have limited how much Texas oil and gas companies are ramping up production

Selling Assets

COOs may choose to sell assets that are not generating acceptable returns on capital employed (ROCE) in order to reduce debt and improve overall financial performance. This decision should be evaluated with the current oil price scenario, which could be favorable

Cost - Control

Focus on cost control: High-performing COOs focus on controlling costs, by looking for ways to optimize their operations and reduce expenses, without compromising on the quality of their products or services

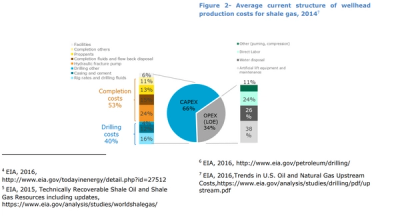

Lease on Operating expenses (LOE) comprises up to 36% - Big portions are Artificial lift (38%), Labor (24%), Water disposal (26%)

Invest in technology and innovations: High-performing COOs invest in technology and innovations that can help them to lower costs of operations, leveraging - digitalization, and data analytics.

For example Investing in AI-based technology and innovations can significantly reduce lease operating expenses in various aspects of oil and gas production, specifically in artificial lift, maintenance, and direct labor.

By analyzing real-time sensor data, AI-based systems can provide autonomous predictive recommendations to eliminate downtime, enhance the lift of the equipment, and review the inflow performance of the wells. This can help to reduce downtime, prolong the life of the equipment, increase the inflow of oil and gas from the well and reduce labor costs, thus improving the efficiency, reliability, and safety of the operations, while also reducing costs.

Large oil and gas operators like Exxon have been leveraging AI to drive exceptionally efficient operations and increase free cash flow. Exxon is using AI by analyzing data from their wells to optimize production. They use AI algorithms to analyze data from sensors on their wells to predict when production will decline and when maintenance is needed. This helps them to schedule maintenance and optimize production to maximize output and minimize downtime.

Overall, Exxon and other large operators are leveraging AI to drive efficient operations, optimize production, supply chain management, logistics and exploration, which results in an increase in free cash flow. By implementing AI-based systems and technology, they are able to reduce costs, improve efficiency, and increase profits, which ultimately leads to higher free cash flow.

Cashflow in 2021 when average closing price was $68.17 and lowest price was $47.62

For smaller operators struggling with the impact of fluctuating oil prices and want to increase cash flow and optimize operations? Sotaog would love to help.

For a limited time we are offering $0 trial for 1 asset so the firm can start seeing the benefits of AI-powered operations. With Sotaog, getting started is easy. We do all the heavy lifting, we take your data in the format you have, typically takes 2-3 meetings to integrate the datasets. Then we start providing real time analysis and recommendations for driving additional cashflow.

With Sotaog, you'll be able to reduce costs, improve efficiency, and increase profits. Our state-of-the-art AI technology is extremely affordable and can enable the team to optimize operations, predict equipment failures, improve production and so much more .