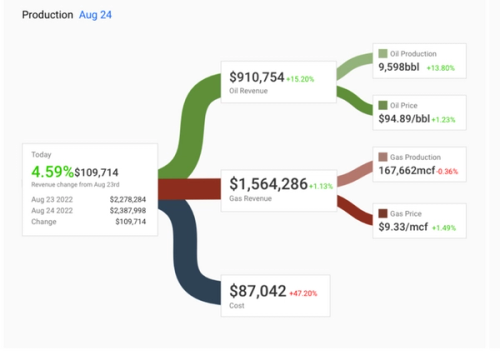

Oil or Gas Production increase is not equivalent to Cashflow increase. Here we have a normal day of operations, Oil Production went by 13.8%, Oil Price was also up by 1.23%, yet the overall increase was only 4.59%

Daily cashflow is dependent on Commodity price, Costs and Production

Production and Costs are under the control of the COO, whereas commodity pricing is not. Fluctuating commodity pricing poses a risk to daily operating cashflow

Step 1 - Estimate revenue and costs on a daily basis (data sets used covered under Step 3). Identify trends that need to be managed, example above we notice the costs go up 40% compared the previous day. Most likely there was a work over or possibly few different repairs on location that drove up the costs

Step 2 - Check against monthly cashflow targets. Are we exceeding targets or are we below expectations. If the below targets review different options to get it back on track.

For example - where daily costs can be trimmed, electric power consumption, water disposal costs, repairs, maintenance are some of the higher LOE costs. One COO reduced 5% of his costs just by optimizing his pumps and reducing power consumption

Review the Production strategy for the wells. Incorporating decline rates, whats the potential given reservoir analysis for the rest of the month, are there wells that need to be brought online to meet targets? If the portfolio has both gas and oil wells, its possible managing chokes more gas production can be brought online

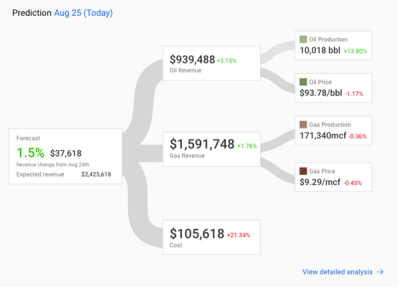

Step 3 - Take action and try to predict the cashflow for the current day. Unify forecasts from different departments within operations to paint the picture.

These are the same datasets for Step 1 as well. Here are different groups

SCADA team - look through live data - (meters or tank levels) and predict Production

Incorporate Unit economics from Accounting and Real time commodity price

Get Production potential of the wells from Production engineering team and check for opportunities to optimize and increase production from existing wells

See if there are actions that can be taken to improve the next day's cashflow

Rinse and Repeat

The above are one of several Predictive analysis that has enabled COOs across the globe to drive 20% increase in Cashflow through predictive analytics.

COOs in the Oil and Gas industry, know how important it is to stay ahead of the game and make strategic decisions based on data-driven insights. That's where Sotaog comes in.

We use advanced several technical engineering (from Reservoir to Electrical) based algorithms to provide recommendations for optimizing the company's cashflow and increasing profitability. Say goodbye to guesswork and hello to a brighter future for the business.

To earn trust, we are offering a $0 trial of the technology.

Send me a note at sarah@sotaog.com to learn more and start maximizing your company's cash flow.