Critical elements of Operating cashflow in Commodity based business

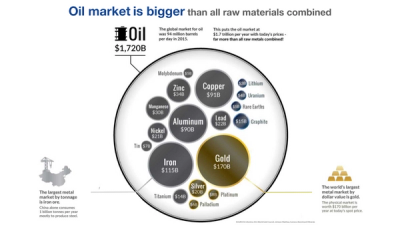

Commodity price is changing every day. This applies to commodities of any type. Commodity markets are easily 20 trillion/year

- Energy Commodities — Crude Oil, Heating Oil, Gasoline Coal, Electricity etc.

- Metal Commodities — Aluminum, Copper, Gold, Silver, Platinum, Steel etc.

- Agriculture Commodities — Barley, Cocoa, Corn, Cotton, Wheat, Sugar etc.

- Livestock and Meat Commodities — Feeder Cattle, Live cattle, Pork Belly, Lean hogs etc.

Crude oil commodities are at 1.7 trillion/year alone.

Operating cashflow is linearly proportional to production of the company. For example, if a firm has 1000s of Production Assets or 7 Production Assets, the cashflow basis for each is unique, there are hundreds of variables let's look at a few

Components - example Machines –number, types of machines, age of the machine, run time, efficiency, capacity potential, cost to run it the relationship between the different machines, just because 1 machine productivity is highest, the next one that it is connected might be inefficient and could constrain the productivity of the plants. Thus, optimization of relationships between the different units is key for Operating cashflow

Cashflow unit index - Each Asset has a unique cashflow index. This is a roll up from the cashflow index of different machines. Let's understand the different variables

Changing commodity prices

Let's take a closer look at an example of Production of Crude oil and how the operating cashflow fluctuates. Example a barrel of oil produced today could be valued at $91.91/barrel. Tomorrow it could be $87.02/barrel, the drop is an instant 6.3% drop in operating cash flow. If the firm was making 69,874 barrels of oil/day. Cashflow dropped from $6,422,119.34 to $6,080,435.48, that's a loss of $341,683.86 in Operating cashflow that the firm has 0 control over. What they can control is continuing to product 69,874 barrels of oil/day. Here is where it gets tricky

In commodity-based businesses, the operating cashflow is a directly proportional to the production of the product. Here we will uncover the elements of the commodity Oil.

According to Mckinsey, there is a 200 billion performance gap due to lack of optimization in operations and inefficiencies. 10 million barrels/day is lost due to inability to maximize efficiency of oil and gas operations

Let's take an example of a company producing 69,874 barrels of oil/day sold at market price of $91.909/barrel. It generates Gross operational cashflow of $6,422,119/day.

It's critical to understand that this production can be generated from

- 159 wells or

- 49 offshore wells or

- 2498 mature wells or

Most important aspect to focus on is to understand how each of these wells produce oil.

1. Reservoir pressure correlation to Production of Oil

Reservoir pressure cannot be controlled. It's based on the depth and location. The reservoir pressure needs to be high, so oil can flow from low pressure to high pressure. Its basic engineering principles

Considering the different types of wells

- For 159 wells- In this case, they are unconventional onshore wells, they could witness upto 70 % decline, and this can happen from 6 months to 1 year. Which means 70% of the oil production could decline, so 69,874 bopd could go to 20,962 bopd, cashflow goes from $6,422,119/day to 1,926,635.802/day. Based on the goals of the company, they will need to keep acquiring acreage to replace the oil reserves. They will need to keep drilling wells to maintain 69,874 bopd.

- 49 offshore wells – Reservoir pressure depletion is not rapid. Production can be forecasted from a stable perspective. Biggest variation on profitability is the Price of Crude (which is pretty volatile). Each of these wells takes 1-3 years to plan & drill, costing about $1B dollars. Low/volatile price environments of $30/barrel to $110/barrel makes the decision basis to drill new wells hard, commodity prices that far in the future is hard to predict

- 2498 mature wells- The reservoir pressure is at its last stages. At this stage, we’re just trying to keep the well online and functional. The biggest risk here is the well could offline anytime

2. Cost of maintaining production of 69,874 barrels/day

- 159 wells- As mentioned above due to the decline in Reservoir pressure, these unconventional wells cannot maintain 69,874 barrels of oil per day. They need an active drilling & completions program to add wells online. The cost is about $5-$8m/well. Daily operating costs per barrel are $7-$10/barrel. The operational costs that can be controlled are the Labor, optimization of moving the oil from the reservoir to sales, etc. It fluctuates significantly. We have seen examples where a team of 50 people managing and they operate 200 wells at approximately 70,000 BOPD and a team of 50 people managing and they operate 100 wells at approximately 30,000 BOPD

- 50 off-shore wells- In this case, the amount of production that can be predicted from reservoir pressure depletion is not that frequent and rapid. Production is more of a stable factor rather than the cost of operations which can be quite high ($25$/barrel). The biggest fluctuation that is faced is the crude oil price. It takes 1-3 years to plan and drill these wells which can cost you around $1B. It becomes difficult to decide to drill these wells due to the volatile oil prices which can vary from $30/barrel to $110/barrel. As the range of the prices is quite unstable, hence makes it difficult to predict.

- 2498 mature wells- Here, the wells can produce 5-40 barrels of oil per day. The operation managers should bracket the production from 5-40 barrels of oil per day. Maintenance of these wells can be considered inexpensive. The operating cost here can vary from $3-$5/day.

The most vital risk that can affect the cash flow of the organizations is that some of the wells can go offline anytime resulting in 0 barrels of oil per day.

Operational Optimization is the Key and needs to be implemented every day:

It's cheaper to optimize production than drilling new wells. Considering the above-mentioned well cases, if we sell each barrel at $65, all the cases are profitable. Ensuring highest margin along with the low cost is the most important metric that the organization should look for.